Social media posts claim the collapse of Silicon Valley Bank (SVB) and others is part of a plan to create a financial panic that allows authorities to implement a central bank digital currency (CBDC), enabling surveillance. This is false; experts say a digital coin plan would not prevent bank failures, and that any new system for consumers is years away.

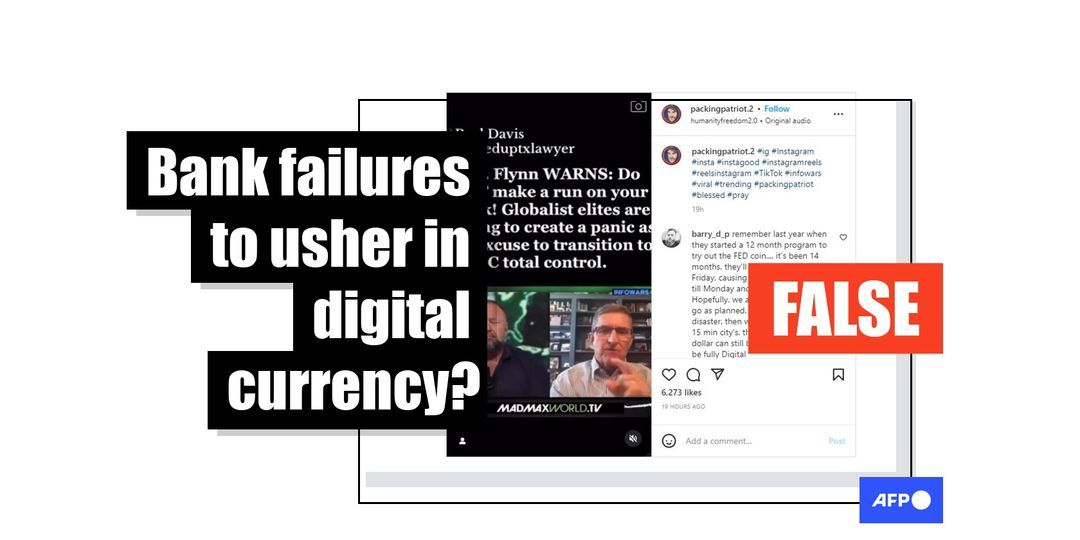

“Global elites are trying to create a panic as an excuse to transition to CBDC total control,” says a March 12, 2023 Instagram post sharing a clip of InfoWars founder Alex Jones interviewing former Donald Trump aide Michael Flynn, who has promoted a range of conspiracy theories.

The same video was shared on TikTok and Facebook, where one user said: “The banks are getting ready to close. So, that is all the precursor for the Central Bank Digital Currency.”

The posts come after the abrupt failure of SVB following a slump in technology stocks and a jump in interest rates that hurt the bank’s balance sheet and sparked a run on deposits, which also affected other financial institutions. US President Joe Biden aimed to limit the fallout March 12 by assuring depositors their cash was safe.

Some posts suggest SVB’s failure is part of an effort to create a crisis that would call for a “solution” involving a cashless society in which financial transactions are monitored. CBDC has previously been the subject of misinformation, with some critics pointing to China’s testing of a system that may increase government surveillance.

Experts say there is no link between bank failures and a CBDC, which is being studied in the United States and elsewhere.

“A CBDC doesn’t change the financial system, it’s just a new thing they offer,” said Josh Lipsky, senior director of the Atlantic Council’s GeoEconomics Center, which follows the progress of CBDC efforts.

Lipsky said the Federal Reserve has moved closer to creating a digital currency, but only for bank-to-bank transactions. He told AFP implementation at the wholesale level “is probably one to three years away,” and that for consumers it could take another three to five years.

Such a change would require input from Congress and the White House, as AFP has previously reported. US officials and the independent Federal Reserve have emphasized the need for privacy protection and a decentralized system.

Lipsky said CBDC is a reflection “that people want to use less cash” and is not connected to bank failures.

Martin Chorzempa, a senior fellow at the Peterson Institute for International Economics specializing in financial technology and digital currencies, said a CBDC would not prevent such failures.

“It would exacerbate the problem,” Chorzempa told AFP, noting most plans would enable depositors to maintain funds in a digital wallet outside the balance sheets of banks with a full guarantee.

“If you create one of these things, the moment there is any instability people would take their money out of the banks and put it into a CBDC, which wouldn’t lead to any useful credit being created,” he added. “It would make the risk of bank runs much worse.”

Experts say the collapse of SVB was not caused by regulators but came as a result of a run on deposits after recent interest rate hikes.

During the coronavirus pandemic — which saw record-low interest rates — SVB moved a large share of its deposits to government bonds, which are usually a safe investment. But as interest rates rose, the market value of those assets fell.

The bank “had a huge exposure to interest rate risk they did not hedge properly, which led to unrealized losses on their bond portfolio,” Chorzempa said. “The precipitating event was that all of these companies (with deposits) pulled their money out quickly in a run on the bank that forced them to sell their securities at a loss.”